2023 Cofinancing Commitments

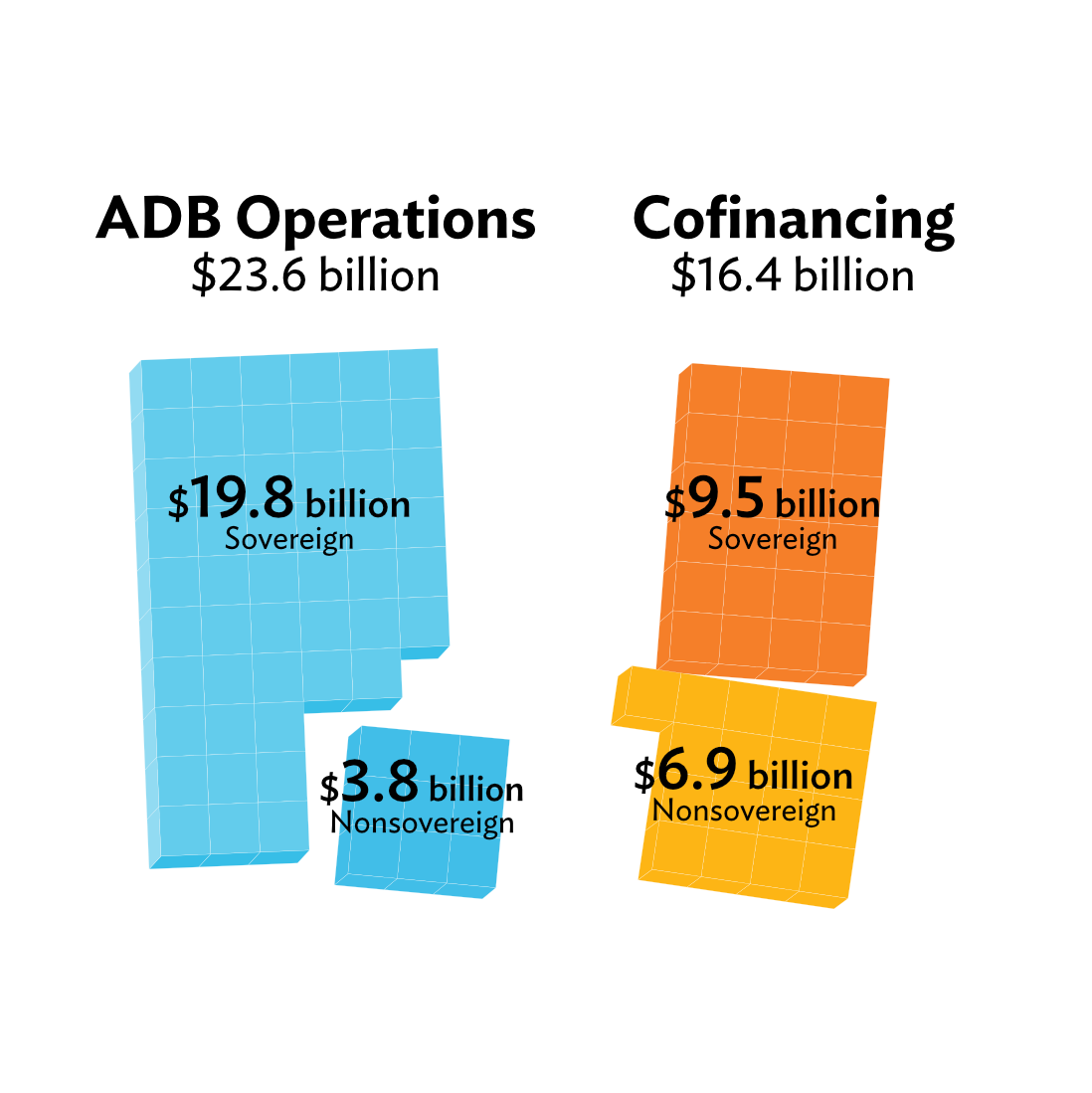

ADB’s total commitments from its resources reached $23.6 billion, supporting 143 projects, 288 technical assistance, and over 21,400 transactions under private sector programs. Commitments for projects and technical assistance to governments of developing member countries (sovereign operations) reached $19.8 billion and investments in privately held or state-sponsored companies (nonsovereign operations) amounted to $3.8 billion.

Complementing these are $16.4 billion from ADB’s financing partners. Roughly $9.5 billion supported 124 sovereign projects and technical assistance while $6.9 billion supported 48 nonsovereign projects, programs, technical assistance, and transaction advisory services. Excluding 2020, when two-thirds of cofinancing was dedicated to COVID-19 interventions, 2023 saw the highest cofinancing from partners. In effect, for every dollar it invested, ADB mobilized an additional $0.69 from diverse sources, consisting of 15 bilateral and 7 multilateral partners, 5 global funds, 3 other partners, 29 trust funds, and a host of private sector entities.

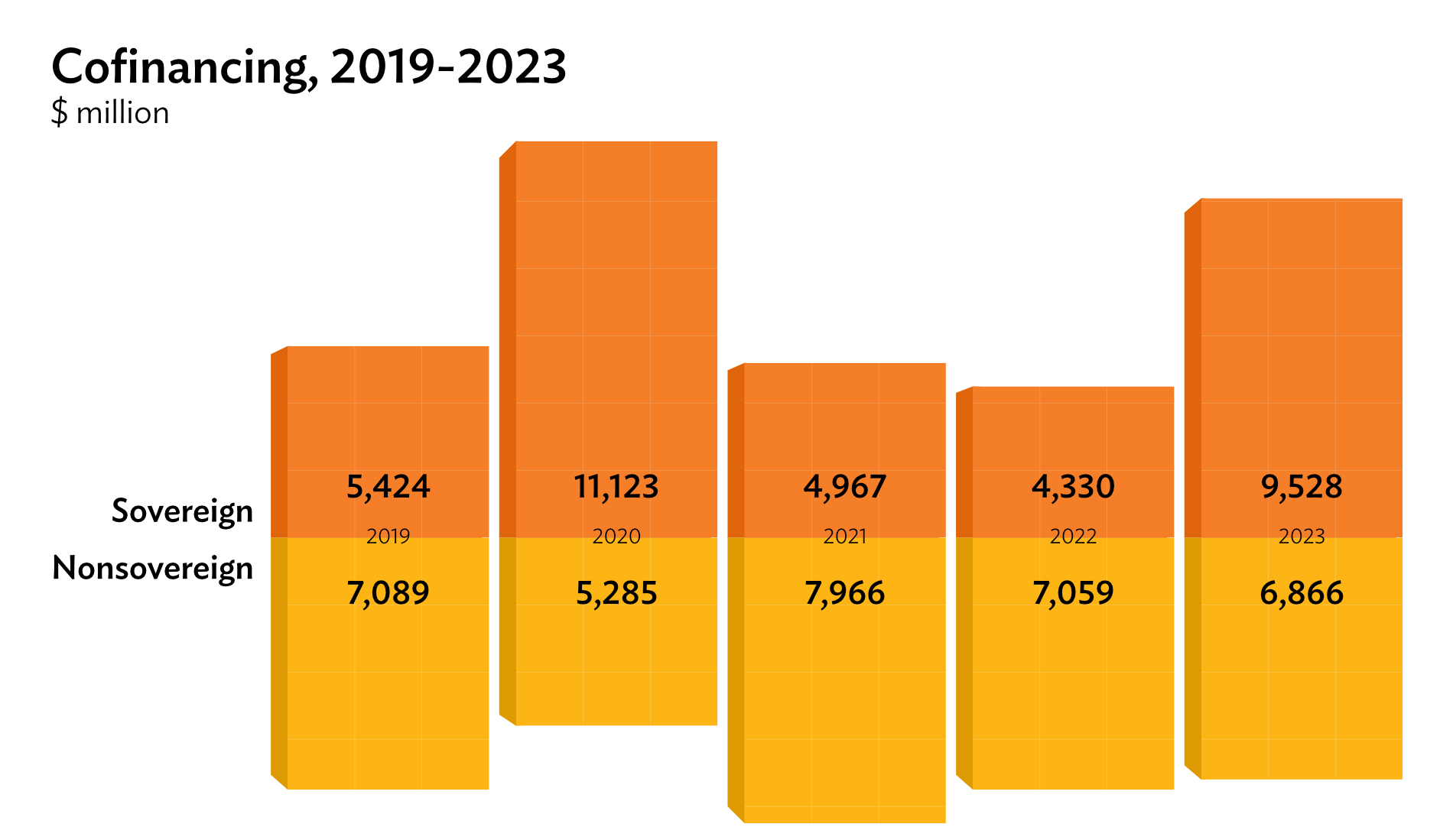

The cofinancing figures for the last 5 years are shown below. 2023 saw a 44% jump in commitments compared to 2022’s total. Factors contributing to this record include the significant increase in policy-based loan cofinancing, principally from the Asian Infrastructure Investment Bank (AIIB) under its extended COVID-19 Crisis Recovery Facility, and a limited number of big-ticket cofinancing, among them Japan’s $1.7 billion support for a railway project in the Philippines and the primary health care project in Indonesia, supported by AIIB ($520 million) and the World Bank ($1 billion). Nonsovereign cofinancing declined by 2.5% from 2022, mainly due to the decline in trade finance caused by global trade slowdown and macroeconomic challenges in key markets. On a more positive note, all other aspects of nonsovereign cofinancing improved. Commitments for projects almost doubled to $3.3 billion, the Microfinance Program topped 2022’s commitments with an additional $75 million, technical assistance increased by 37%, and another $443 million in private sector investments were mobilized for two transaction advisory services that reached financial closure in 2023, up from $60 million in 2022.

Cofinancing Partners

For sovereign operations, 2 of ADB’s 12 multilateral partners account for 62% of the $9.5 billion commitments to investment projects—the Asian Infrastructure Investment Bank (AIIB) with $4.8 billion and the World Bank with $1.2 billion.

Among the 15 bilateral partners, major contributors included Japan ($2.1 billion), France ($413 million), Germany ($283 million), the Republic of Korea ($190 million), and the People’s Republic of China ($140 million).

The global funds—Climate Investment Funds, Global Agriculture and Food Security Program, Global Environment Facility, Green Climate Fund, and the Women Entrepreneurs Finance Initiative—collectively committed $82 million.

Some 29 trust funds supported cofinancing operations in 2023—21 supporting sovereign operations, 7 supporting nonsovereign operations, and 1 supporting both.

Two entities joined ADB’s roster of financing partners in 2023—the Global Energy Alliance for People and Planet (GEAPP), with whom ADB established a new trust fund to accelerate inclusive energy access for the poor and vulnerable population; and the International Finance Facility for Education (IFFEd), where ADB will join the IFFEd global funding facility to advance education and skills development for the region’s poorest children and youth. ADB will also begin accessing the Pandemic Prevention, Preparedness, and Response Trust Fund after signing an agreement to be its implementing agency.

New Partnerships

ADB established three new financing partnership facilities in 2023: (i) the Innovative Finance Facility for Climate in Asia and the Pacific, (ii) the IFFEd Financing Partnership Facility; and (iii) the Ocean Resilience and Coastal Adaptation Financing Partnership Facility.

Eight new trust funds also became operational in 2023, most of them providing further impetus for climate action, such as the ones on ocean resilience and coastal adaptation, urban resilience, water resilience, energy access and transition, and green finance (European Union and the United Kingdom). Two of the new trust funds support nonsovereign operations—the Nonsovereign Revolving Trust Fund and Leading Asia’s Private Infrastructure Fund 2 or LEAP 2, the successor to LEAP which concluded in August 2023. The contributions for the new trust funds came from the governments of Japan, the Netherlands, the Republic of Korea, and the United Kingdom; the European Union; the Global Energy Alliance for People and Planet; and the Nordic Development Fund.

Cooperation agreements were also signed with various partners in 2023, including ADB’s re-accreditation to the Green Climate Fund, the Financial Framework Partnership Agreement with the European Union; the cofinancing framework agreement with the Asian Infrastructure Investment Bank; the agreement for ADB to be an implementing agency of the Pandemic Prevention, Preparedness, and Response Trust Fund; and Memoranda of Understanding with the Saudi Fund for Development and the European Training Foundation. These agreements will promote collaboration and cofinancing on climate change, renewable energy, sustainable transport, urban development, and pandemic preparedness, to name a few.

Climate Cofinancing

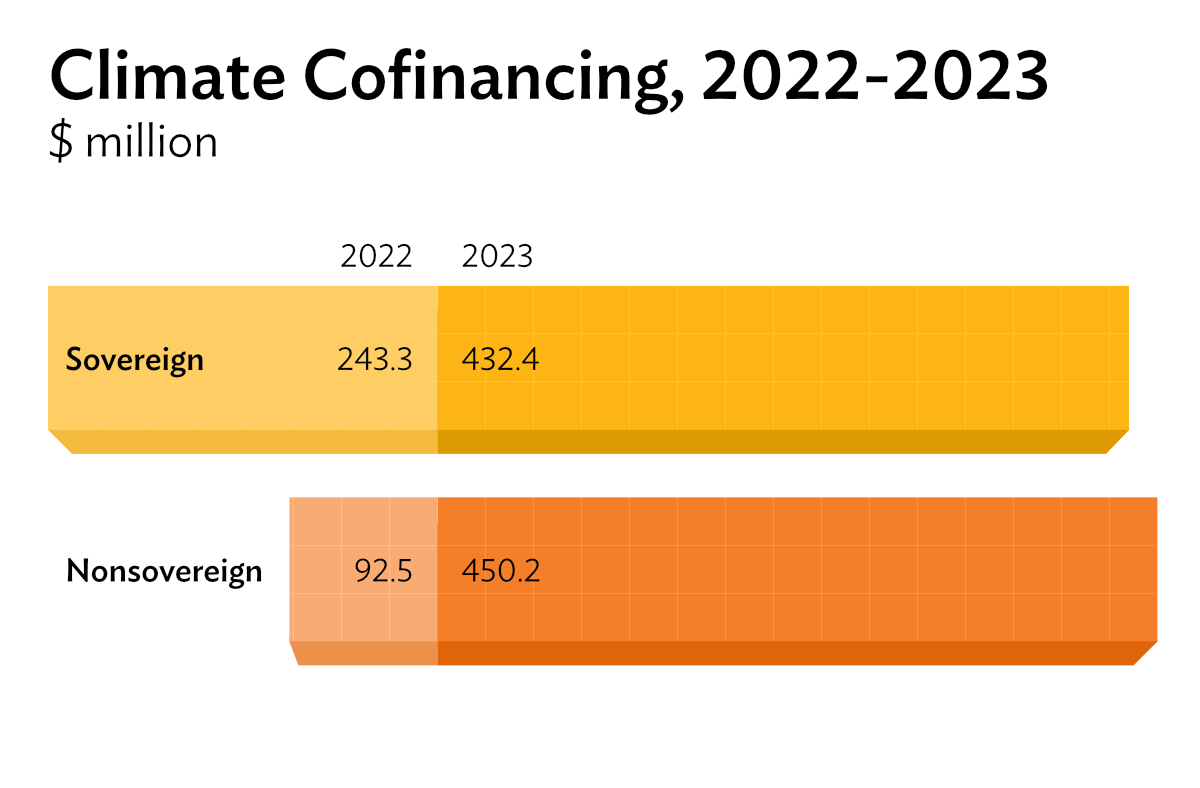

The climate crisis poses a grave threat to development, with women, children, and other vulnerable segments of the population facing a bigger share of this threat. Heeding the urgency of the crisis, ADB, in 2023, committed from its resources a record $9.8 billion to climate action, up from $6.7 billion in 2022.

Developing Asia and the Pacific, however, needs more to maintain its growth momentum, eradicate poverty, and respond to climate change. Joining forces with countries, partners, and the private sector is one way to ensure that the scope and impact of ADB’s climate actions are amplified.

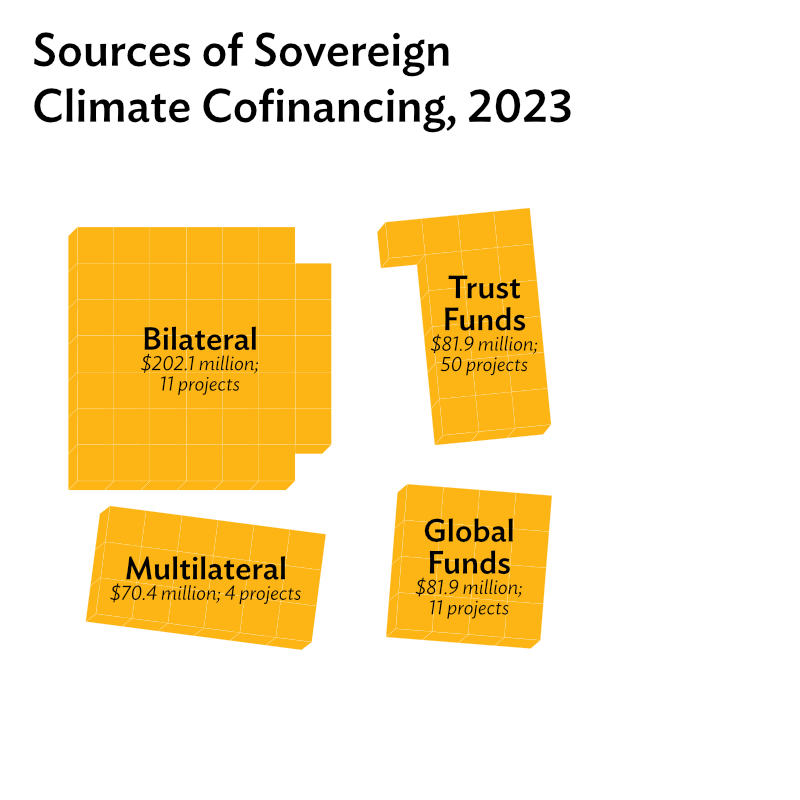

From its partners, ADB mobilized $883 million—$841.8 million for investment projects and $40.8 million for technical assistance—representing a 163% increase from 2022’s climate cofinancing total of $335 million. Below is the breakdown for sovereign and nonsovereign climate cofinancing.

For sovereign operations, France cofinanced four climate-related projects with $171.5 million; the Green Climate Fund followed with three projects and $51.7 million commitments. Japan supported the greatest number of projects at 14, with $37 million in cofinancing.

Among the sovereign climate-related projects that the partners supported in 2023 are the following:

For nonsovereign operations, 20 climate-related projects and technical assistance plus multiple private sector transactions were supported by eight trust funds, private sector programs— namely, the Trade Supply and Finance Chain Program (TSCFP) and Microfinance Program—and numerous private sector partners.

Through the TSCFP, ADB reduced the environmental impact of Bangladesh’s clothing industry by helping finance a textile spinning mill factory with new, high-technology, low-energy equipment. The result has been a doubling in export output, creating many jobs, while reducing the mill’s environmental impact. The TSCFP also financed a small enterprise in Georgia that manufactures innovative thermal building panels that reduce energy waste. This financing, in partnership with Basisbank in Georgia, helped the company expand to the extent that it is now exporting its green products to Azerbaijan and Armenia.

Among the climate-related nonsovereign projects supported by partners are the 600-megawatt wind power project in the Lao People’s Democratic Republic (Lao PDR), which will deliver the first cross-border wind power plant in Asia, the largest in Southeast Asia, and the first in the Lao PDR; the support for the recovery of tourism-oriented small and medium enterprises and blue economy in Maldives; and the development, construction, and operation of a polyethylene terephthalate (PET) recycling facility in Indonesia.

Sovereign Cofinancing

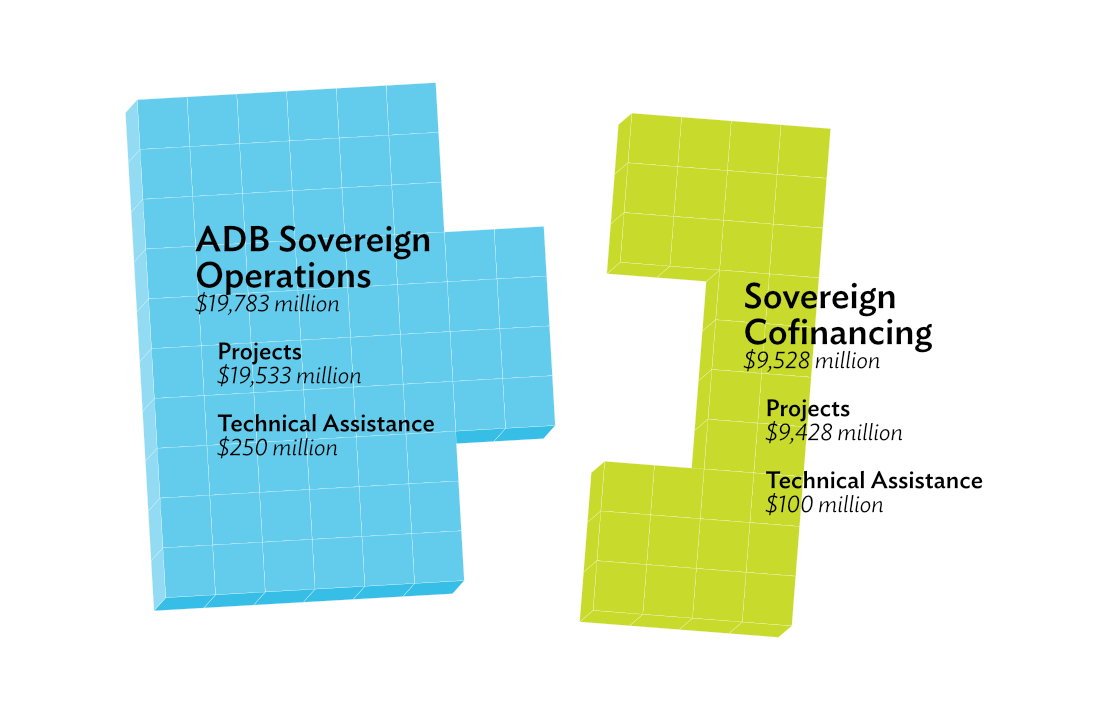

Sovereign cofinancing for 2023 totaled $9.5 billion, more than double the $4.3 billion mobilized in 2022.

A total of 124 sovereign projects and technical assistance (TA) benefited from these external resources, broken down as follows:

- 28 projects with loan cofinancing of $9.2 billion

- 25 projects with grant cofinancing of $219.4 million

- 76 technical assistance with grant cofinancing of $99.6 million

The ratio of sovereign cofinancing against total ADB sovereign operations is 48%, a radical jump from 2022’s 26%.

See the dashboard and project maps for details.

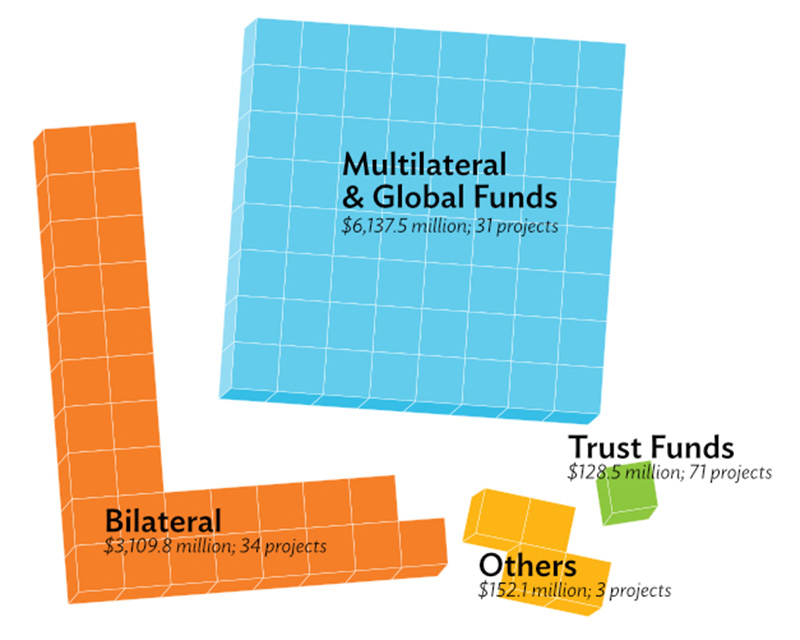

by Modality

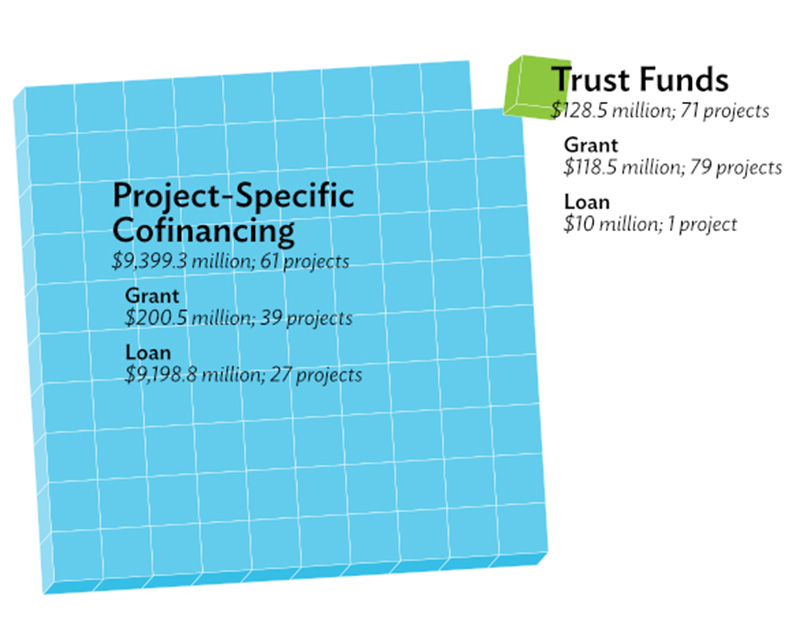

Project-specific cofinancing for 61 projects accounted for 99% of cofinancing. The rest, commitments from trust funds amounting to $128.5 million, supported another 71 projects and technical assistance.

See the sections on project-specific cofinancing and trust funds for details.

by Loan or Grant

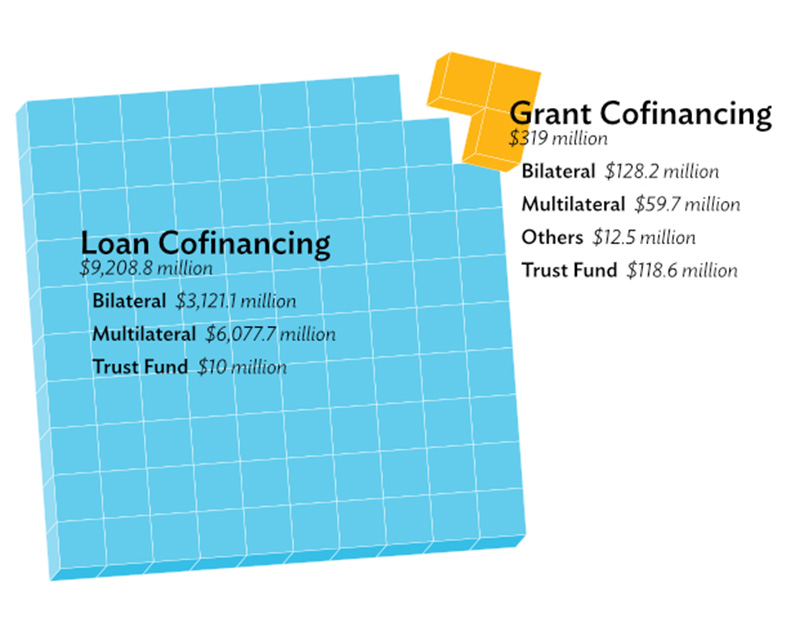

Of the $9.5 billion cofinancing committed, $9.2 billion were loans that ADB’s partners provided alongside ADB’s loans. The rest were grants, $219 million for projects and $100 million for technical assistance.

Multilateral partners provided the bulk of the loans while most of the grants were mobilized from bilateral partners.

by Source

In 2023, 15 bilateral and 7 multilateral partners, 5 global funds, 22 trust funds, and 3 other partners supported 124 projects and technical assistance.

As bilateral partners and excluding their commitments via trust funds, Japan, France, and Germany committed $2.1 billion, $413 million, and $283 million, respectively. Australia supported the highest number of projects, 10, followed by France, with 6.

The Asian Infrastructure Investment Fund (AIIB) and the World Bank, between them, committed 97% of the $6.1 billion commitments from multilateral partners. AIIB supported 11 projects while two global funds, the Green Climate Fund and Climate Investment Funds supported 4 projects each.

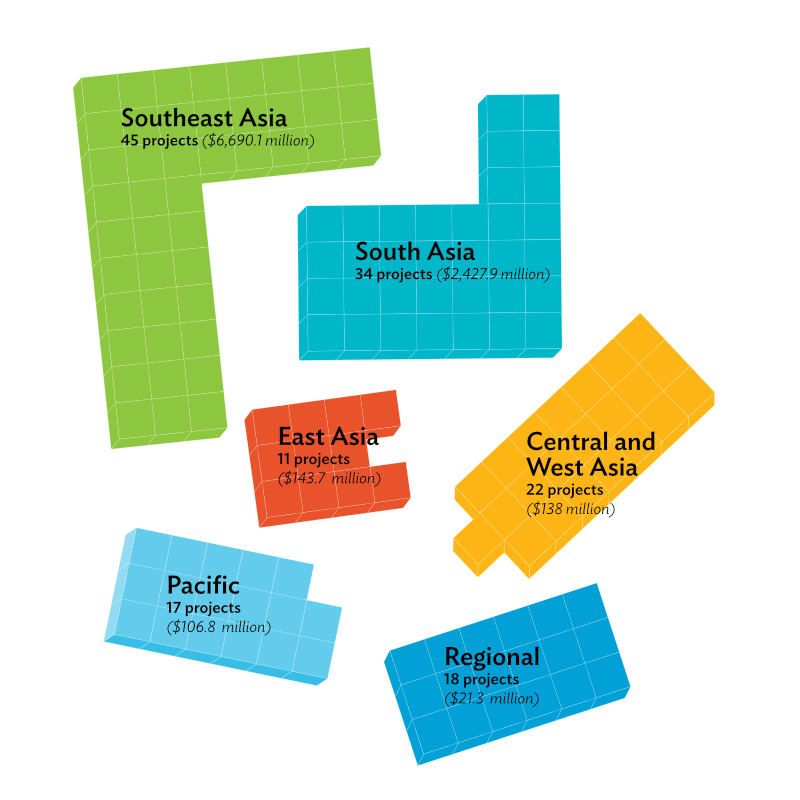

by Region

Forty-five projects in Southeast Asia accounted for 70% of cofinancing commitments in 2023, totaling $6.7 billion. This included a railway project connecting to the planned Metro Manila subway in the Philippines, with $1.7 billion cofinancing from Japan; a project to help reduce flood risk for roughly half a million people in the Cimanuk-Cisanggarung and Seluna river basins in Indonesia, supported by the United Kingdom; and improving the employability of Cambodia’s human capital through skills building, supported by France.

South Asia accounts for the next highest volume in cofinancing, with partners committing $2.4 billion (25% of sovereign cofinancing) to 34 projects. Among the projects were Nepal’s efforts to reform its school education system, supported by partners including the European Union and the governments of Finland and the United States; and India’s move to reform its power sector and facilitate integration of renewable energy, supported by Germany.

The remaining commitments from partners supported 22 projects in Central and West Asia, 17 in the Pacific, and 11 in East Asia.

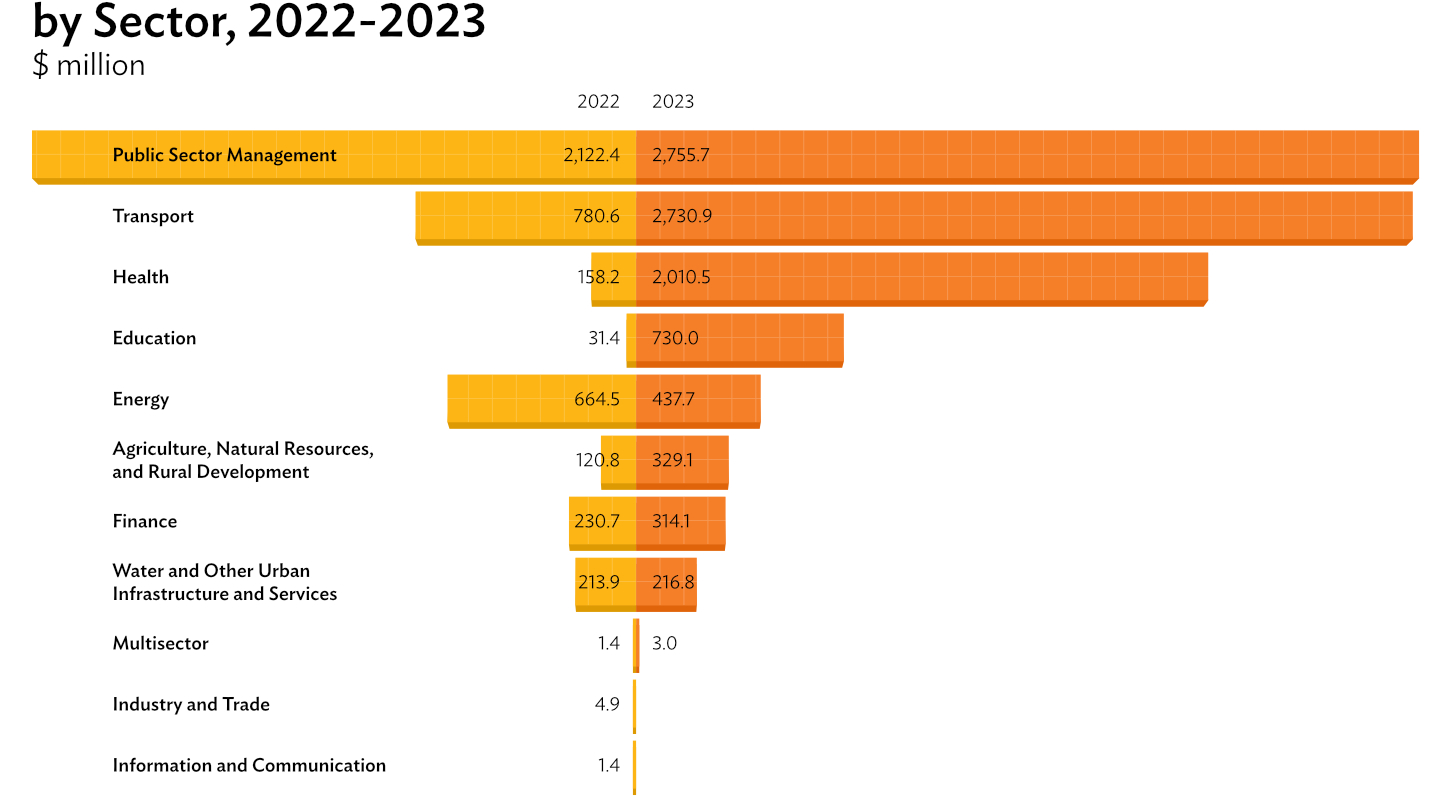

by Sector/Theme

The public sector management ($2.7 billion), transport ($2.7 billion), and health ($2 billion) sectors account for 79% of sovereign cofinancing.

In terms of volume, the education and health sectors almost doubled their cofinancing compared to 2022. Cofinancing for transport and agriculture projects also significantly increased by 71% and 63%, respectively. The biggest decline in volume was felt in the energy sector.

In terms of the number of projects supported, the biggest increases were in the transport, health, and energy sectors.

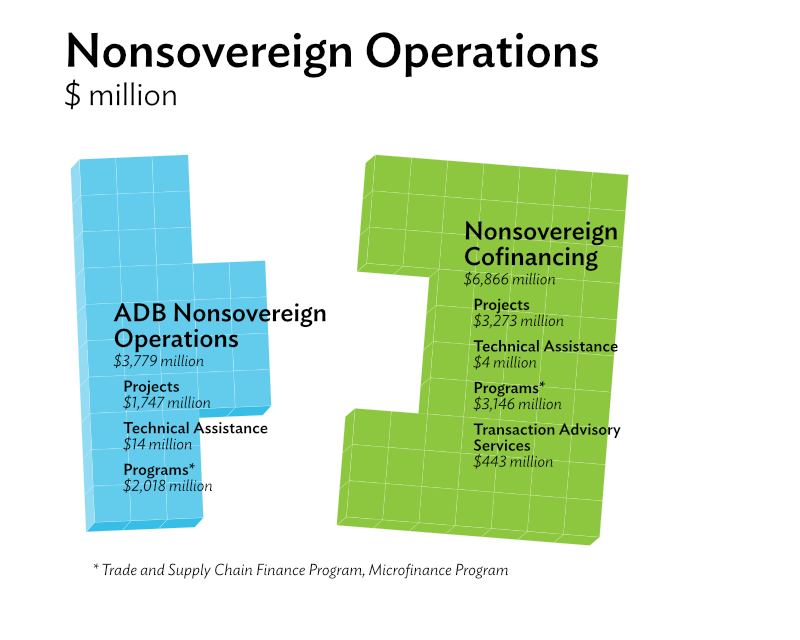

Nonsovereign Cofinancing

Nonsovereign cofinancing for 2023 totaled $6.9 billion, slightly lower than 2022’s total of $7.1 billion. Macroeconomic challenges in key markets and the slowdown in global trade were the main drivers of the decline, with cofinancing for the Trade and Supply Chain Finance Program (TSCFP) contracting to $2.9 billion from 2022’s $5.2 billion. However, the number of transactions doubled to 21,400 due to the growth of the supply chain business where the TSCFP did more transactions at a lower dollar value.

Cofinancing for other aspects of nonsovereign operations improved, starting with the $3.3 billion cofinancing for projects, almost doubling the volume in 2022. Cofinancing for transaction advisory services increased to $443 million, up from $60 million in 2022. Cofinancing for technical assistance rose by 37%. Cofinancing for the Microfinance Program also rose by $75 million, reaching $245 million in 2023.

The long-term nonsovereign cofinancing, which serves as the basis for computing the nonsovereign cofinancing ratio, rose to 2.7 from 2022’s 1.8.

A total of 48 projects, programs, technical assistance (TA), and transaction advisory services (TAS) benefited from these resources, broken down as follows:

- 39 projects with cofinancing of $3.3 billion

- 4 TAs with cofinancing of $4.1 million

- 2 TAS with cofinancing of $443 million

- 3 programs (Trade and Supply Chain Finance Program and Microfinance Program), with cofinancing of $3.1 billion supporting 21,400 transactions

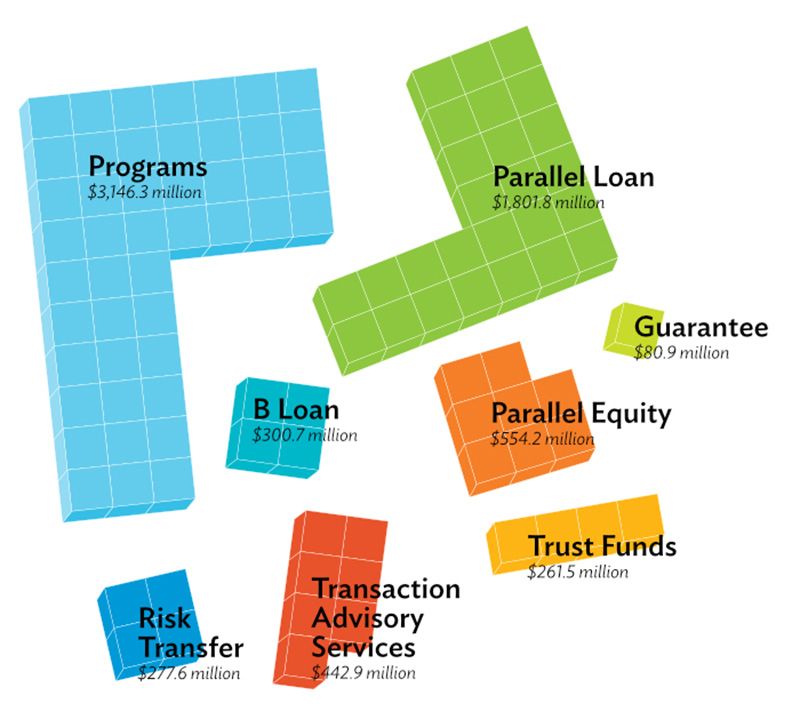

by Product and Source

The bulk of cofinancing for projects was mobilized from parallel loans ($1.8 billion), followed by parallel equity ($554 million), and B loans ($300.7 million). See the nonsovereign operations section for more details. Partners also supported nonsovereign operations through cofinancing from seven trust funds.

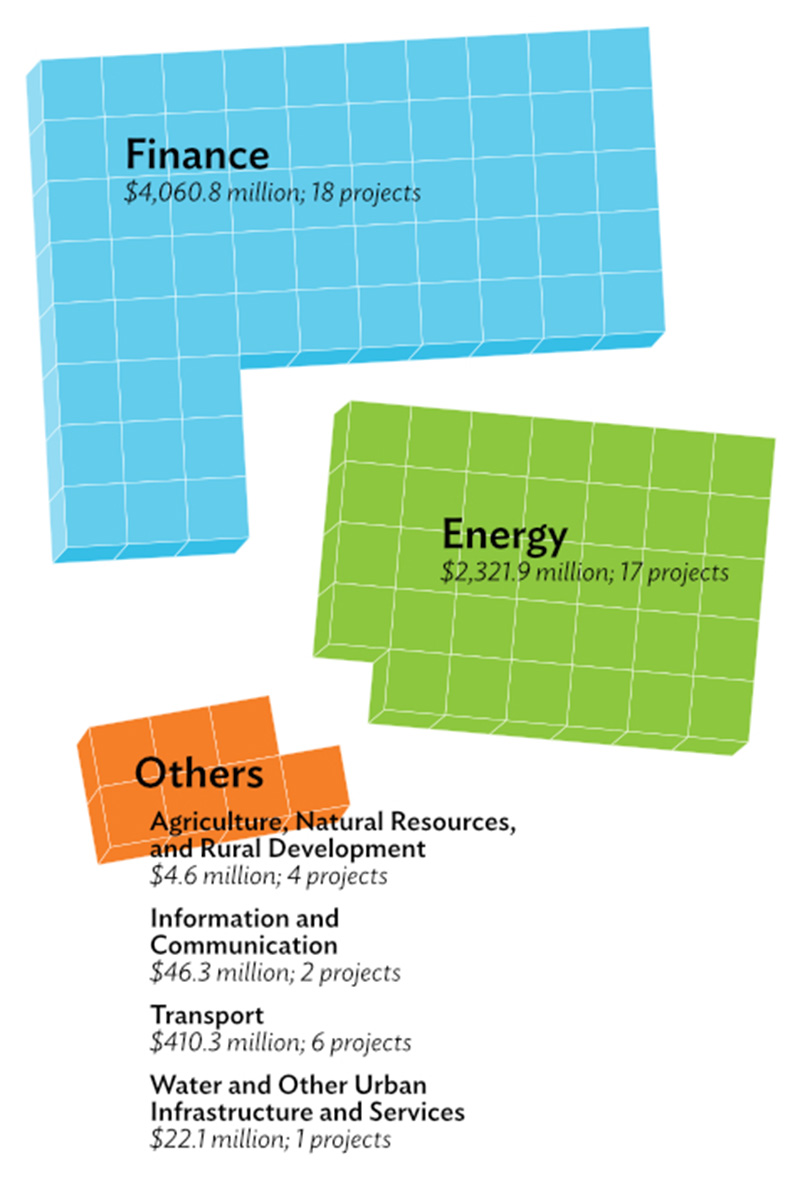

by Sector and Theme

The finance sector received 59% of cofinancing at $4.1 billion, covering 18 nonsovereign operations including the two private sector programs, the Trade and Supply Chain Finance Program (TSCFP) and the Microfinance Program (MFP). The energy sector followed with $2.3 billion, 34%, supporting 17 nonsovereign operations.

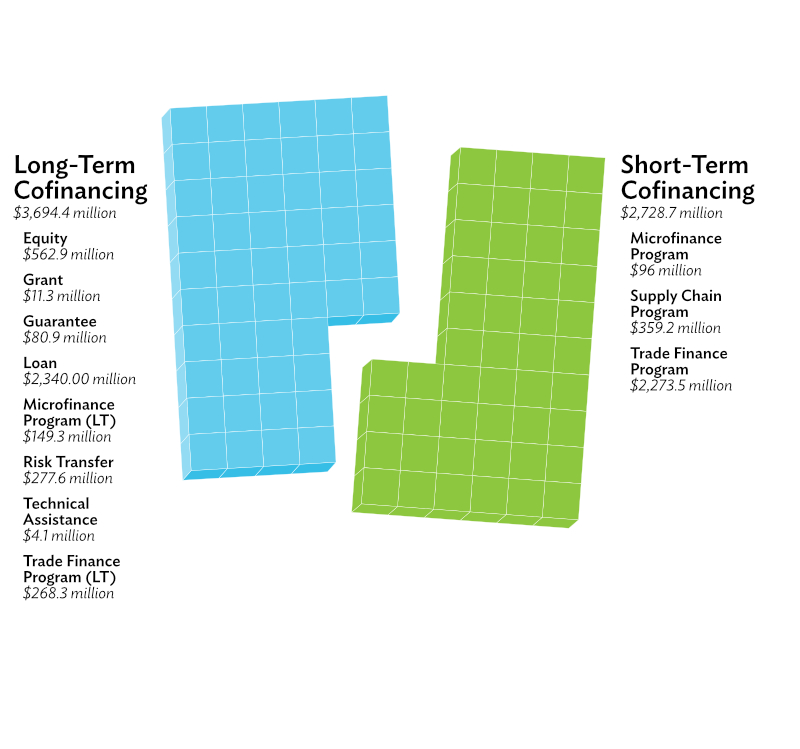

by Tenor

Short-term cofinancing, which typically lasts less than a year, mainly covers transactions under the TSCFP and MFP. It accounted for 42% of the $6.4 billion cofinancing for private sector operations (less transaction advisory services).

At $3.7 billion, long-term cofinancing—which includes grant, equity, guarantee, loan, and technical assistance cofinancing; risk transfers; and some longer-term transactions under the private sector programs—almost doubled from the 2022 total.

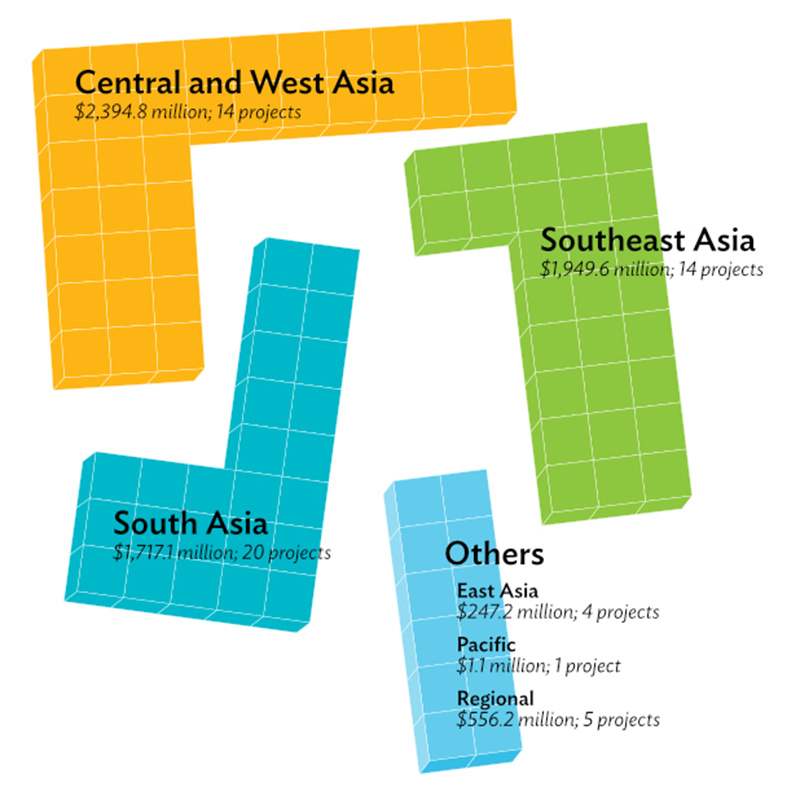

by Region

In terms of volume of cofinancing, countries in the Central and West Asia region received $2.4 billion in commitments or 35% of nonsovereign cofinancing. Southeast Asia and South Asia followed with $1.9 billion and $1.7 billion, respectively.

In terms of the number of cofinanced projects, South Asia topped the list with 20 projects, followed by Central and West Asia and Southeast Asia with 14 projects each.

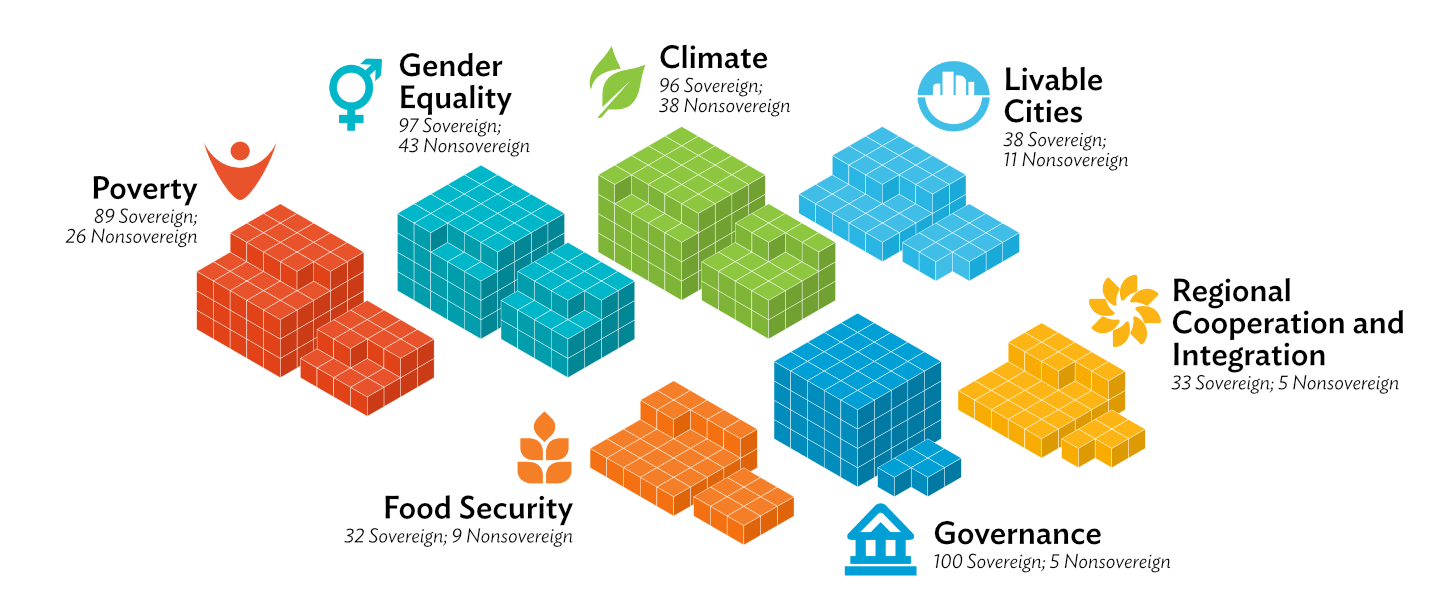

Strategy 2030 Operational Priorities

ADB continued to pursue its vision of a prosperous, inclusive, resilient, and sustainable Asia and the Pacific in 2023, tirelessly working with partners and stakeholders to respond to the challenges brought about by the global climate crisis, food insecurity, persistent poverty, and other critical issues for the region.

Each project, program, or technical assistance that ADB undertakes supports one or more operational priorities (OPs) of Strategy 2030.

In 2023, the 124 sovereign and 48 nonsovereign cofinanced operations were tagged against the OPs as follows: