Nonsovereign Operations

Listen to the article

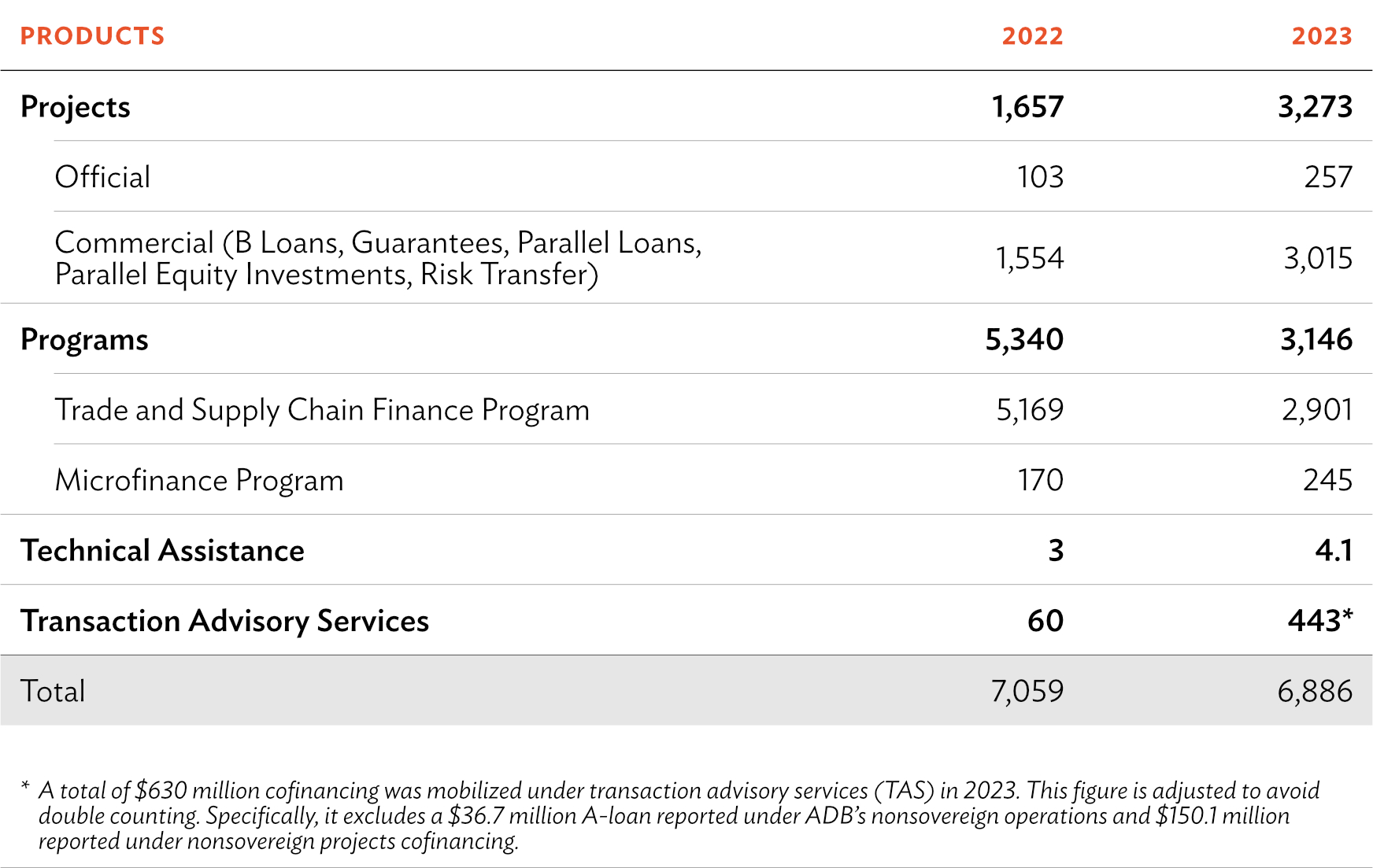

Cofinancing from ADB’s nonsovereign operations in 2023 amounted to $6.9 billion, slightly lower than 2022’s figure of $7.1 billion. However, several positive developments can be observed in 2023.

To start with, project cofinancing under the different project modalities—B loans, risk transfers, parallel cofinancing, and official cofinancing—jumped to $3.3 billion, almost double 2022’s $1.7 billion total. This helped the 2023 cofinancing ratio (CFR)1 to rise to 2.7, setting a positive trajectory to reach the 2030 target of a 2.5 CFR average for 3 years.

Cofinancing for technical assistance and transaction advisory services also increased by 37% and 638%, respectively.

Overall cofinancing for ADB’s nonsovereign programs—the Trade and Supply Chain Finance Program (TSCFP) and the Microfinance Program—declined from $5.3 billion in 2022 to $3.1 billion in 2023, despite an increase of $75 million (44%) in cofinancing for the latter. Macroeconomic challenges in key markets and the slowdown in global trade were the main drivers of the decline. On a positive note, the number of TSCFP transactions more than doubled from 10,100 in 2022 to 21,400 in 2023, largely due to growth in the supply chain business.

Finally, private sector partners committed $450 million to climate-related investments in 2023, up from $92.5 million in 2022.

Projects

Long-term cofinancing from projects increased twofold—from $1.7 billion in 2022 to $3.3 billion. One of the notable projects committed in 2023 was the Monsoon Wind Power Project in the Lao PDR, where ADB led and mobilized a financing package of $583 million for the project, the largest syndicated renewable project financing transaction in the ASEAN region. ADB’s concessional financing package of $50 million consisted of loans of $20 million from the Leading Asia’s Private Infrastructure Fund (LEAP) and $30 million from the Canadian Climate Fund for Private Sector in Asia.

Third-party funds also boosted the financing partnerships in 2023. ADB and the Japan International Cooperation Agency (JICA) formalized an agreement to launch the LEAP 2, endowed with $1.5 billion in capital from JICA. The fund aims to cofinance high-quality, resilient, and sustainable infrastructure projects. The multi-donor Nonsovereign Revolving Trust Fund was also established in 2023, with an initial commitment of $3 million from the Republic of Korea, to invest in private companies and projects that can have a significant development impact in Asia and the Pacific.

B Loans

B loans are loans funded by commercial banks and other eligible financial institutions with ADB acting as a lender of record. For instance, in 2023, ADB and Maxwealth Financial Leasing Co., Ltd. signed a $136 million (CNY1 billion) financing package to support lease financing for micro, small, and medium-sized enterprises and spur inclusive growth and job creation in the People’s Republic of China. The package also marked the revival of the C loan (B loan in local currency), which amounted to $68 million, since the last of its type was committed in 2020. ADB’s support included facilitating introductions between the client and financial institutions with whom they had no prior relationship, thereby expanding the client’s potential funding sources.

Guarantees

ADB’s guarantees support infrastructure projects, financial institutions, capital market investors, and trade financiers. They cover a wide variety of debt instruments. To catalyze capital flows into and within its developing members for eligible projects, ADB extends guarantees for eligible projects, which enables financing partners to transfer certain risks that they cannot absorb or manage on their own to ADB. These guarantees can be a “partial credit guarantee,” where ADB provides comprehensive cover to cofinanciers against commercial and political risks, or a “partial risk guarantee,” with ADB covering some of the risks associated with a loan. An example of a guarantee committed in 2023 was a project that aims to boost the renewable energy capacity of the Philippines, which has traditionally relied on coal to meet its growing electricity needs.

Official Cofinancing

Official cofinancing, where ADB cofinances with bilateral and multilateral partners, also includes public sector lending windows of export credit agencies. In 2023, with cofinancing from LEAP, ADB and Saudi Arabia’s ACWA Power signed an agreement to develop the Bash and Dzhankeldy wind power projects in Uzbekistan. The two projects will be equipped with 158 turbines and are expected to generate 3,235 gigawatt hours of clean energy while displacing two million tons of carbon emissions annually. The projects are some of Central Asia’s largest, utility-scale wind power plant financing.

Parallel Cofinancing

Parallel cofinancing is cofinancing provided by third-party cofinanciers to a project alongside ADB. This can either be a parallel loan or a parallel equity. The former is a third-party loan in transactions that have ADB’s direct loan or equity participation. The latter is a third-party equity investment in a private equity fund or a transaction where ADB makes a direct investment. In 2023, ADB signed a $41 million finance package with the Bank of Maldives Plc to support locally owned small and medium-sized enterprises and tourism companies in Maldives. The project includes parallel loans of up to $13 million from the Japan International Cooperation Agency (JICA) and $5 million from the Development Bank of Austria (OeEB). The parallel loans from JICA and OeEB are the first commercial cofinancing that ADB mobilized for Maldives.

Risk Transfer

A risk transfer is an agreement between ADB and a financing partner under which—through insurance policies, risk participation agreements, or other similar contracts—the partner assumes a portion or all of ADB’s risk of loss.

First Cross-Border Wind Power Project in Asia

ADB and Monsoon Wind Power Company Limited signed a $692.6 million project financing package to build a 600-megawatt wind power plant in Sekong and Attapeu provinces in the southern region of the Lao People’s Democratic Republic (Lao PDR). With 133 wind turbines, the project will be the largest wind power plant in Southeast Asia and the first in the Lao PDR. It will export and sell power to neighboring Viet Nam.

The B loan comprises $100 million from Siam Commercial Bank and $50 million from Sumitomo Mitsui Banking Corporation, while the concessional financing administered by ADB includes $20 million from the Leading Asia’s Private Infrastructure Fund and $30 million from the Canadian Climate Fund for the Private Sector in Asia. The project also has parallel loans of $120 million from JICA, $100 million from Kasikorn Bank, $72.6 million from the Asian Infrastructure Investment Bank, $60 million from the Export-Import Bank of Thailand, and $30 million from the Hong Kong Mortgage Corporation Limited.

Cross-border power supply has been a pillar of the Lao PDR’s economic growth. Harnessing the country’s untapped wind resources can provide energy diversification, as the seasonality of the wind resource is countercyclical to the rainy season, which supports the country’s hydropower generation. The project will reduce annual greenhouse gas emissions by at least 748,867 tons of carbon dioxide equivalent.

Programs

Trade and Supply Chain Finance Program

In 2023, the number of transactions under the TSCFP increased by 112%, rising from 10,115 transactions in 2022 to 21,416 transactions in 2023. This is largely due to growth in the supply chain business, which mostly involves small and medium enterprises (SMEs). The TSCFP did more transactions at lower dollar value, supporting 680 more SME transactions in 2023, for a total of over 6,900. More than 2,800 transactions supported intra-regional trade while 1,300 transactions supported trade between developing member countries. The four most active countries were Viet Nam, Bangladesh, Pakistan, and Uzbekistan, with the latter being a major growth market for the TSCFP during the year.

As projected at the end of 2022, the macroeconomic challenges in key TSCFP markets such as Pakistan and Sri Lanka, and the overall slowdown of global trade, resulted in the dollar value of TSCFP transactions dropping from $7.7 billion in 2022 to $4.7 billion in 2023.

Cofinancing for the TSCFP totaled $2.9 billion. This represents 62% of the $4.7 billion total TSCFP transactions, in line with TSCFP’s commitment to effectively leverage private sector involvement.

Advancing the climate action agenda in 2023, the TSCFP supported climate-positive transactions valued at $166 million. Examples include steel for recycling, wastepaper, electric vehicles, and solar deals. The program also developed a new Green Equipment Facility to support companies acquiring energy-efficient equipment to reduce the carbon intensity of their supply chains.

In addition, the TSCFP implemented the Environmental and Social Management Systems at banks throughout developing Asia. These systems help screen transactions for sustainability and social standards.

In 2023, the TSCFP amplified its impact through a range of projects, initiatives, knowledge products, and solutions, including:

Climate tracking and reporting

The TSCFP developed a unique partnership to help transparency and traceability in global supply chains, with an initial focus on tracking greenhouse gas emissions end-to-end and helping supply chains demonstrate compliance with leading climate (and other) standards. The program is working to leverage advanced QR code technology to track carbon emissions and report against authoritative climate standards.

Fighting trade-based money laundering

The TSCFP is working to enhance the sharing of data and best practices in the fight against trade-based money laundering (TBML). The program facilitated a transformative collaboration within and between five developing member countries participating in a TBML reporting project.

Helping SMEs succeed in sustainable trade

The TSCFP is driving the development of Deep Tier Supply Chain Finance, which aims to push financing deeper into the underserved, farthest reaches of complex supply chains. SMEs and microenterprise suppliers face challenges accessing financing that will help them engage in trade.

The program is also working with the UN/WTO International Trade Centre to develop a solution that will help navigate, understand, leverage, and comply with sustainability and environmental, social, and governance-related standards and regulations.

Microfinance Program

In 2023, the Microfinance Program (MFP) helped mobilize local currency financing of $477 million. Roughly 51% of this—or $245 million—is cofinanced. Cofinancing in 2023 increased by 44% compared to the previous year due to the expansion of operations in existing and new markets, such as Uzbekistan and Georgia.

By the end of 2023, the program had active relationships with 7 partner financial institutions and 27 active microfinance institutions (MFIs) across ADB developing member countries, including Bangladesh, Cambodia, Georgia, India, Indonesia, Pakistan, the Philippines, and Uzbekistan.

Through the Microfinance Program, ADB and its partners aim to address the poor access to financial services in most of ADB’s developing member countries. Through its credit-enhancement products for wholesale lending to MFIs, ADB’s program expands the risk appetite of private financing institutions. Women living in rural and peri-urban areas comprise more than 90% of those supported by the program, with loans averaging less than $400, making the MFP highly gender-inclusive and centered on building rural livelihoods. In 2023 alone, more than a million micro-borrowers have benefited.

The program’s technical assistance (TA) work continues to complement its financing activities and objectives. Current TA projects under the program include capacity building for MFIs and increasing the climate change and disaster resilience of their clients, through delivering home improvement loans and micro insurance.

Technical Assistance

In 2023, TA cofinancing reached $4 million. This involved four TA projects.

The Republic of Korea’s Ministry of Economy and Finance committed a $3 million cofinancing to expand the ADB Ventures Seed, a program that provides catalytic funding to early-stage companies with tech-enabled solutions to validate and deploy their operations in developing Asia. The Seed program has funded over 40 companies in a range of sectors, including e-mobility, energy efficiency, and climate-smart farming, to encourage cross-border technology transfer and knowledge sharing in almost 20 of ADB’s developing member countries. It generates proprietary deal flow for ADB Ventures, an investment operation that provides equity financing of up to $4 million to companies to scale technology for climate impact.

Supplementary cofinancing was extended to four TA projects.

- Fostering Regional Cooperation and Integration through the Knowledge and Capacity Building of Trade and Supply Chain Finance Program helps banks receive additional funds for greener, transparent, and inclusive global trade and supply chains.

- Smartchem Technologies Limited: Building Capacity for Climate Resilience and Soil Nutrition Management among Smallholder Farmers will develop demonstration farms as outdoor classrooms and deliver training programs and seminars for farmers.

- Strengthen Implementation of Gender Mainstreaming in Nonsovereign Investments intends to address gaps in client capacity and support delivery of gender development results.

- ABIS Exports Private Limited: Building Capacity for Climate Change Adaptation in Smallholder Fish Farming aims to train farmers on best practices in climate-resilient farming in aquaculture.

Boosting Green Start-Ups and Supply Chains

The ADB Ventures Seed program provided catalytic funding to early-stage companies with tech-enabled solutions generating climate impact to validate and deploy their operations in developing Asia.

Viet Nam’s Selex Motors provides specifically designed e-scooters for last-mile delivery along with battery swapping stations. Each gasoline motorbike replaced by a Selex electric scooter results in a net carbon emissions reduction of 0.45 tons of CO2 equivalent per year. Selex has already set up 51 swap stations and boosted its capacity to 20,000 electric motorbikes and 100,000 packs of lithium-ion batteries annually.

In Indonesia, Blitz Electric Mobility is facilitating the electric transition of last-mile delivery operations, along with optimized solutions for drivers and customers. The company currently operates in 20 cities nationwide and provides tailored delivery services for over 44 enterprises. The company has completed over 1.6 million deliveries to date, all on electric vehicles.

APX offers less-than-truckload services to optimize trucking logistics in Thailand. The company aims to build a connected transport network across the ASEAN region in the long run, to improve logistics efficiency, reduce the number of trucks needed on the road, and reduce CO2 emissions.

Transaction Advisory Services

In 2023, transaction advisory services (TAS) mobilized $6302 million of private sector investments through public–private partnerships. Notable investments committed in 2023 include the development of a solar power plant in Sherabad City in Uzbekistan and the expansion of a 13.5-kilometer road connecting Chittagong and Sylhet to Central Dhaka in Bangladesh.

The solar project in Uzbekistan is the largest utility-scale solar project in Central Asia. It is expected to provide green, affordable, and sustainable power to about 3 million residents and support industrial activity. It has potential export capability to neighboring countries.

The investment project in Bangladesh will widen an expressway in Central Dhaka in Bangladesh that will provide an alternative and less-congested gateway to and from the capital, easing access from the center of the city to residential areas and other cities. ADB assisted in project structuring, negotiations, and tender execution.

ADB provides advisory services for the delivery of bankable public–private partnership projects attractive to the private sector. This includes the management of the Asia Pacific Project Preparation Facility, a multi-donor trust fund with contributions from the governments of Australia, Canada, Japan, and the Republic of Korea.

Unlocking Uzbekistan’s Renewable Power Potential

The Asian Development Bank and Abu Dhabi Future Energy Company PJSC signed three loans to build three solar power plants in Uzbekistan’s Surkhandarya (Sherabad), Samarkand, and Jizzakh regions. Together, these power plants can generate 897 megawatts, making them the region’s largest solar power development.

The financing package is composed of three loans from ADB’s ordinary capital resources amounting to $36.7 million for Sherabad, $13.5 million for Samarkand, and $14.3 million for the Jizzakh power plant. Additionally, ADB mobilized much-needed private institutional capital for the three power plants. This was achieved through the arrangement of an aggregated B loan syndication of $37.5 million. The B loan participant is ILX Fund I, an Amsterdam-based emerging market private credit fund focusing on sustainable development goals.

ADB is joined in the financing of the three projects by the Asian Infrastructure Investment Bank , the European Bank for Reconstruction and Development , and the European Investment Bank as parallel lenders.