Sovereign Operations

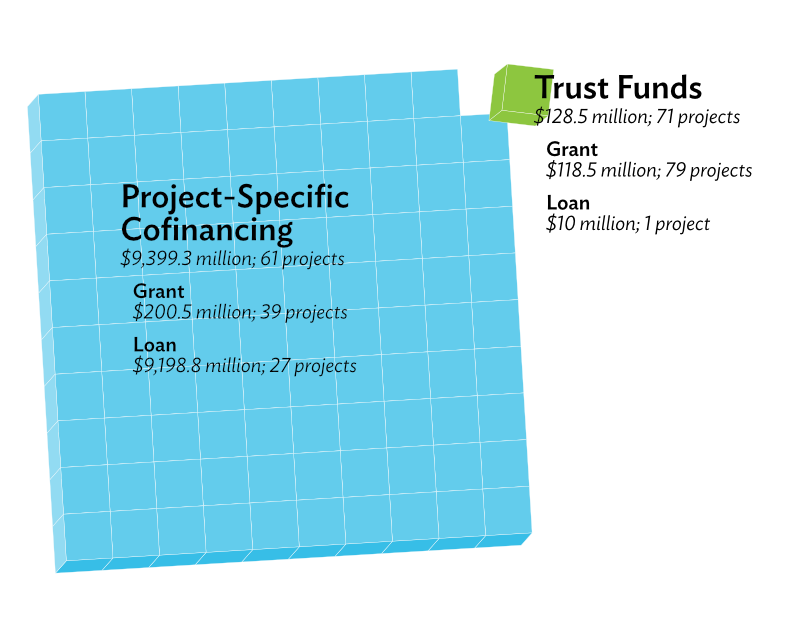

Partners can support ADB’s sovereign operations either through project-specific cofinancing (PSC) or trust funds. The latter is when they directly contribute to specific programs, projects, or technical assistance (TA). Some partners opt to support projects that focus on specific themes or areas. So, they build a trust fund earmarked for such initiatives or support an existing one fully administered by ADB.

In 2023, ADB’s partners committed $9.5 billion to support sovereign grants, loans, TA, and investments. Of this, $9.4 billion was coursed through 61 PSCs and $128.5 million through 71 trust funds–supported projects.

The year 2023 saw the highest levels of PSC since 2020 in terms of both volume and count. The volume of PSC more than doubled at a 124% increase, from $4.2 billion in 2022 to $9.4 billion in 2023. The number of PSC projects also increased from 51 to 59. These PSCs were supported by 24 financing partners, comprising 12 bilateral partners, 7 multilateral partners, and 5 global funds.

ADB also administered 48 active trust funds in 2023. These trust funds support various development priorities that partners share with ADB, such as disaster risk management, clean energy, private sector development, and more. Of the 48 trust funds, 8 were established in 2023.

Climate cofinancing for sovereign projects amounted to $432 million in 2023.

Project-Specific Cofinancing Trust Funds

Nonsovereign Operations

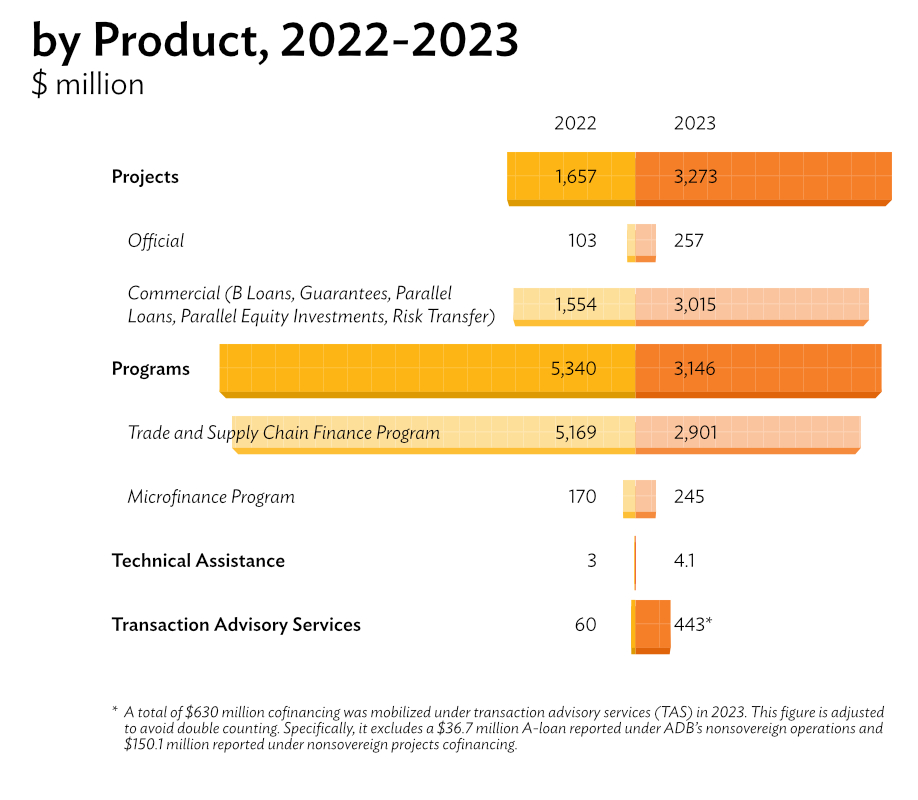

Cofinancing from ADB’s nonsovereign operations in 2023 amounted to $6.9 billion, slightly lower than 2022’s figure of $7.1 billion. However, several positive developments can be observed in 2023.

To start with, project cofinancing under the different project modalities—B loans, risk transfers, parallel cofinancing, and official cofinancing—jumped to $3.3 billion, almost double 2022’s $1.7 billion total. This helped the 2023 cofinancing ratio (CFR)1 to rise to 2.7, setting a positive trajectory to reach the 2030 target of a 2.5 CFR average for 3 years.

Cofinancing for technical assistance and transaction advisory services also increased by 37% and 638%, respectively.

Overall cofinancing for ADB’s nonsovereign programs—the Trade and Supply Chain Finance Program (TSCFP) and the Microfinance Program—declined from $5.3 billion in 2022 to $3.1 billion in 2023, despite an increase of $75 million (44%) in cofinancing for the latter. Macroeconomic challenges in key markets and the slowdown in global trade were the main drivers of the decline. On a positive note, the number of TSCFP transactions more than doubled from 10,100 in 2022 to 21,400 in 2023, largely due to growth in the supply chain business.

Finally, private sector partners committed $450 million to climate-related investments in 2023, up from $92.5 million in 2022.

Projects Programs Technical Assistance Transaction Advisory Services